Am I Eligible for Spousal Support?

Under Ohio law, Ohio Revised Code § 3105.18, “spousal support” means any payment or payments to be made to a spouse or former spouse, or to a third party for the benefit of a spouse or a former spouse, that is both for sustenance and for support of the spouse or former spouse.

“Spousal support” does not include payments from separate property or non-marital property. The law defines certain types of property as belonging solely to one individual instead of being shared by the couple in marriage. An individual will not be required to pay spousal support from the money that was obtained through separate, non-marital property.

In divorce and legal separation proceedings, upon the request of either party and after the court determines the division or disbursement of property, the Court of Common pleas may award reasonable spousal support to either party. During the pendency of any divorce or legal separation proceeding, the court may award reasonable temporary spousal support to either party.

An award of spousal support may be allowed in real or personal property, or both, or by decreeing a sum of money, payable either in gross or by installments, from future income or otherwise, as the court considers equitable.

Factors to Determine the Amount of Spousal Support

- The income of the parties, from all sources, including, but not limited to, income derived from property divided, disbursed, or distributed;

- The relative earning abilities of the parties;

- The ages and the physical, mental, and emotional conditions of the parties;

- The retirement benefits of the parties;

- The duration of the marriage;

- The extent to which it would be inappropriate for a party, because that party will be the custodian of a minor child of the marriage, to seek employment outside the home;

- The standard of living of the parties established during the marriage;

- The relative extent of education of the parties;

- The relative assets and liabilities of the parties, including but not limited to any court-ordered payments by the parties;

- The contribution of each party to the education, training, or earning ability of the other party, including, but not limited to, any party’s contribution to the acquisition of a professional degree of the other party;

- The time and expense necessary for the spouse who is seeking spousal support to acquire education, training, or job experience so that the spouse will be qualified to obtain appropriate employment, provided the education, training, or job experience, and employment is, in fact, sought;

- The tax consequences, for each party, of an award of spousal support;

- The lost income production capacity of either party that resulted from that party’s marital responsibilities;

- Any other factor that the court expressly finds to be relevant and equitable.

Contact Our Dayton, Ohio Spousal Support Attorneys Today

If you need a dedicated Ohio spousal support attorney, then call Gounaris Abboud, LPA for your free consultation. Remember, time is of the essence in all family law matters. If you are in doubt about your legal rights in an Ohio spousal support case, then contact the legal attorneys or lawyer of Gounaris Abboud, LPA for your free case analysis.

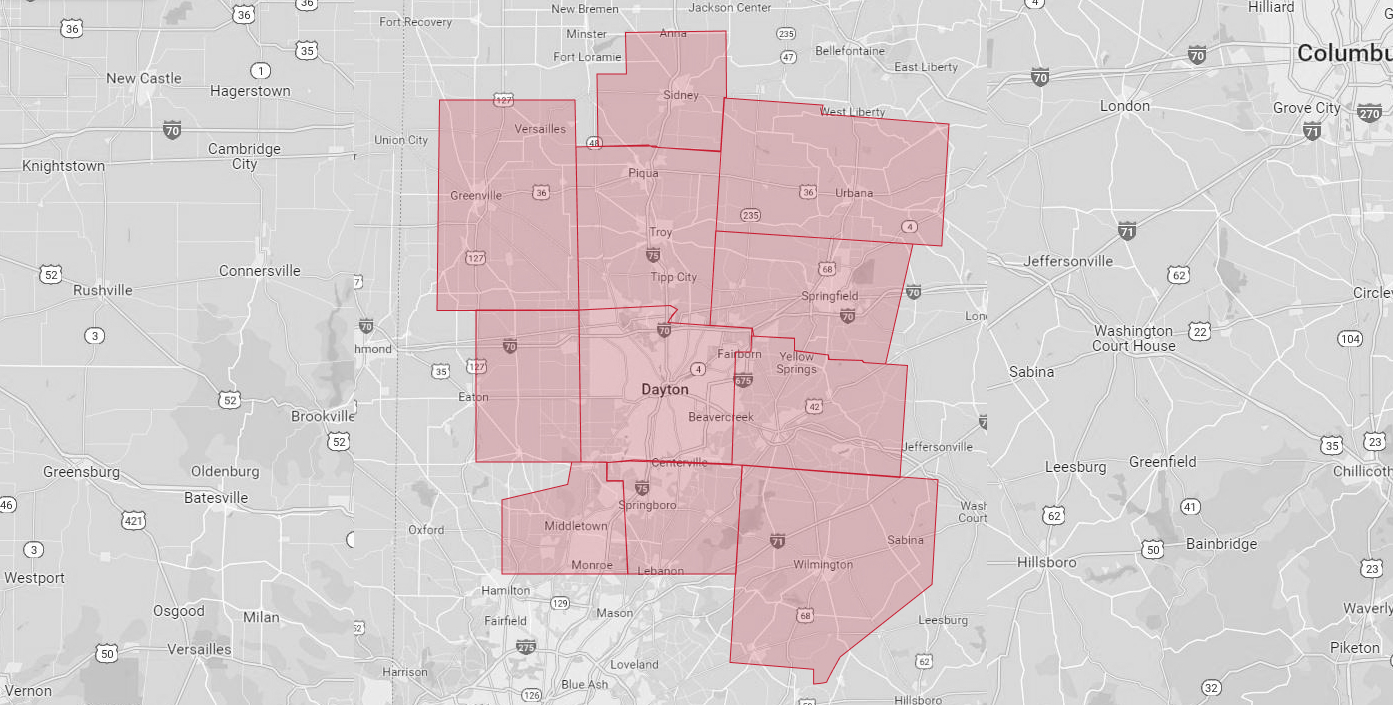

Do not face a family law matter without knowing your rights; At Gounaris Abboud, LPA, protecting your rights is all we do. Our attorneys are licensed to practice in the state of Ohio and concentrate their practice in the following Ohio counties: Montgomery, Greene, Miami, Warren, Butler, Preble, Darke, Logan, Clinton, Shelby, Champaign, Clark, Clermont, and Hamilton, Ohio.

Contact the Dayton Spousal Support attorneys of Gounaris Abboud, LPA for your free case analysis at 937-729-3964.